Economics in Nouns and Verbs:

A discussion on how mathematical language shapes the way we understand the economy

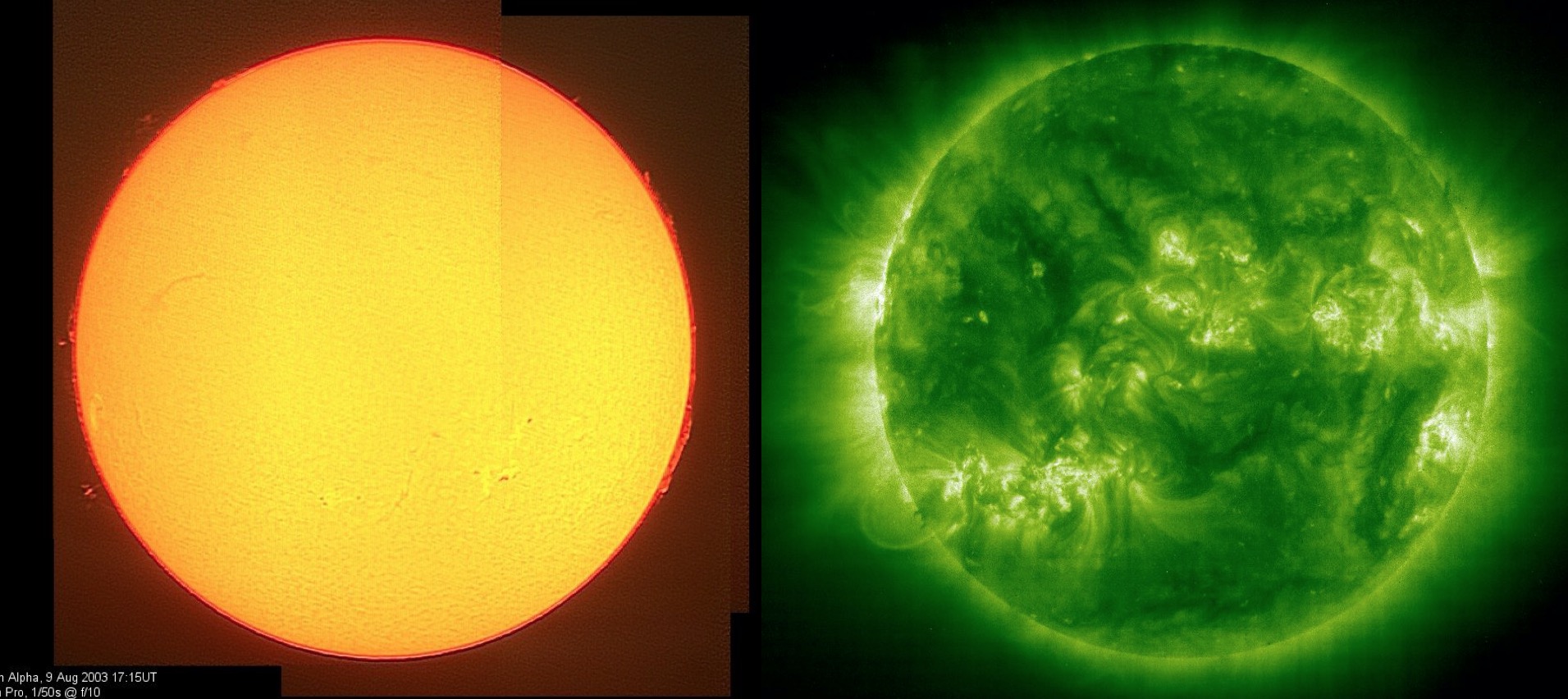

Science uses instruments — the telescope, microscope, magnetic resonance imaging — to probe and explore and explain. These become means of understanding, and often different means show us different versions of "reality." When standard telescopes look at the Sun they see a sphere of uniform radiating energy; when X-ray telescopes examine the Sun they see a sphere with jagged fissures and far from uniform. Mathematics, in science, is a means of understanding; it probes and explores, and so it's worth asking what it can "see" and not "see" easily in the economy. Certainly, as the key method behind economic theory these days, algebraic mathematics has brought clarity to economics, as well as a great deal of prestige. But it has a limitation. Algebra and calculus are about relations and balance among noun-quantities, and so they allow only nouns. Their explanations must therefore be constructed completely from noun-things — quantities, rates, prices, levels, amounts, indices. Verbs — actions and processes — cannot be directly included in equation-based economic explanations; at best they can only be talked about indirectly. This restricts the explanatory stories economic theory can tell. It forces theory to leave out matters to do with actions, events, process, formation, and creation. Algebraic mathematics works as a language for economic theory, but it hampers expression.

There is a mathematics that easily includes actions or processes in economic theory: algorithmic mathematics, or computational modeling, if you prefer. It allows verbs — actions and processes — as well as nouns — objects and quantities. Thus it allows modeling in economics that can deal with formation: of markets, institutions, arrangements, economies, and structures, and this opens economic theory to a wider and richer world.

Publication. The paper is on ArXiv in preprint form and has not yet been submitted to a journal. Publishing suggestions or invitations are welcome.

Some Q & A about Economics in Nouns and Verbs

Question: What is this paper really saying? What is its main point?

Arthur: Mathematics is a means of understanding; it probes and explores what we are looking at, and so I wondered what it shows us and what it can't easily show us in economics. What I discovered surprised me. Standard mathematics —standard algebra and calculus — can deal only with quantitative nouns: it allows literally only nouns. It does not allow verbs — actions, events, processes, creation — not directly anyway. This may seem a minor observation, but it has consequences. Theory in economics has largely come to be taken as mathematics, but that means it must build its understandings only from nouns. And so equation-based economics can't talk easily about processes, or formation, or creation. This means a whole vast territory of economics can't be easily treated formally. For example, economic development is not a set of adjustments to GDP. It proceeds from millions of actions happening and reinforcing each other. It is a process, a complex set of interacting processes.

Q. Is there a remedy for this?

A. Yes, computational methods allow us to include verbs directly: actions and processes. Algorithms (or algorithmic mathematics, if you want to be more formal) allow processes and actions and events, and these give us a much wider language for expression in economics. They describe step-by-step methods, or procedures, for how some outcome unfolds. Algorithms also contain if-then clauses, so we can have descriptions saying: If process G and H have been completed, and if process M has begun, then call (execute) sub-process K. So with computational description, we can allow for actions: actions inhibiting other actions, actions triggering other actions, actions calling other actions. We have a flexible language where systems can move and change and form and re-form themselves according to the context they are part of. Algorithms are already used in parts of game theory, market design for example. Solutions here are not equation-based conditions; they are processes: of bidding, or allocation, or forming some structure, or arriving at some outcome. Using algorithms we can tell process-based "stories" that are richer by far than the standard noun-restricted ones. Stories about formation and structural change and creation and development.

Q. Where did this idea about nouns and verbs in economics come from?

A. In 2013 or so, I became fascinated with computation and started to look seriously into what Alan Turing had done in 1936 in making methods — algorithms, we'd now call them — an object of study in mathematics. This was great fun. I noticed that Turing was producing mathematical results — settling Hilbert's decidability problem for example — by using the notion of algorithms as mathematical objects in his proofs. I also got fascinated with Greg Chaitin's algorithmic information theory — a rigorous mathematics of algorithms as mathematical objects. And around about the same time I started to look into the history of algebra and was surprised to see it took about 130 years for it to gain acceptance in science, roughly between 1590 and 1720. Geometry was mathematics in the 1600s. Newton himself, a bit slyly, called algebra "the analysis of bunglers in mathematics."

I wondered was something similar going on now. Was computation the new algebra? Could computation be a form of mathematics in some sense? So I asked myself what algebra really did, and realized it was a form of arithmetic, and dealt only in nouns. Quantitative nouns. That was a shocker. It followed that if "theory" is taken as equation-based mathematics only, it is restricted only to nouns. That was another shocker. Theory is about telling explanatory stories and I couldn't see how you'd tell stories only in nouns. I talked about this briefly in a 2015 paper and also in a lecture I gave in Singapore in March that year. The idea kept haunting me so I wrote it up.

Q. Why has nobody noticed this noun-restriction before?

A. I don't know. I'm sure someone will unearth an earlier mention of it somewhere. Kenneth Boulding was close when he pointed out in 1992 that equations allowed only 4 verbs: is equal to, is greater then, it less than, and is a function of. It's a lovely insight. Boulding was super-smart and wise, but regrettably he didn't develop it further.

Q. Are you against mathematics?

A. No, not at all. On the contrary. Most of my training is in mathematics. My PhD solved an open mathematics problem; I've published in math journals, and much of my earlier work was on nonlinear stochastic processes, which are fairly technical. I really love mathematics, all sorts of mathematics.

Q. Are you against equation-based mathematics in economics then?

Again no. I believe algebraic mathematics is powerful in economics and necessary; it has contributed a lot. But we need to be aware of its limitations, in particular that it forces all explanations to be constructed from noun-quantities. Any method of insight can contribute understanding in a science, but it can see only what is visible in its own band of the spectrum, and we need to be aware that mathematics can't easily see processes or actions.

There's one style of mathematics in economics I'm not keen on however. Around the 1960s a rather extreme version of mathematics came into economics, to the degree that economic theory is now often taken to be a form of mathematics, complete with theorems and lemmas and proofs. This is overblown, and I am certainly against what I call hyper-mathematics — the dressing up of standard mathematics in highfalutin terms. We don't need to know something is a Lebesgue-Stieltjes integral, or is valid in the space of real numbers. That is not done in either physics and in engineering, and I suspect it betrays a feeling of inferiority in economics — that we have to prove ourselves more rigorous-than-thou when we do mathematics. We economists have no need to feel inferior. Rigor doesn't come from dressing up simple results in pretentious terms. It comes from adopting realistic, verifiable assumptions and reasoning logically from there.

Q. Is your paper an attack on orthodox economics?

A. [Laughs.] No, not at all. I don't believe there's such a thing as "orthodox" versus "heterodox" economics. Who decides that? Some in-group for their own benefit? We are all economists, doing economics. What is considered conventional by journals and practitioners changes all the time, and economics has been widening in this regard in the last few years. Behavioral economics and complexity economics are hardly "heterodox" (if you want to use that term) any more. Both approaches are now widely accepted, especially among younger economists. Complexity economics opens us up to computational modeling, and this allows us to drop the old, restrictive assumptions of standard economics, and also to model processes. This is to be welcomed in economics. In this regard we are catching up with movements in mathematics and physics and philosophy that allow process. Such changes are inevitable in economics and it's shortsighted to deem them "allowable" or not "allowable." We need to be more daring in economics.

Q. You say that there are many ways to do economic theory.

A. I don’t believe that given the complication of the economy and the humanness of the people who act within it, there is any privileged way to view the economy. There are useful ways and less useful ones. In economics we have many means of understanding besides mathematics: narrative discourse based on close observation; insights via geometry, or via computation, or via economic history, or via examining statistics. All these show different things; and all I believe are legitimate. I'd like to see theory widen again and accept these as legitimate.

Given this view, I don't think algebraic mathematics is the only way to express theory. That's an idea Paul Samuelson tried to sell us in the 1940s, but now it looks severely outdated. Theory is about discovering, understanding, and explaining phenomena present in the world; at bottom it's a set of principled explanations for what we see in the world. When I first started to study economics, at Berkeley in 1970, my advisor was the mathematician David Gale, and he recommended I read Samuelson's Foundations — an attempt to formally mathematize economics. I read the book and got the idea, but in the end I wasn't impressed. It seemed that Samuelson was making huge efforts to mimic physics: constrained optimization was his hammer, and every issue in economics became a nail. Eventually I learned more from economic history and economic development than from all the theorems. In 1970 the hyper-mathematical approach to economic theory was just coming in, and among theorists and others it was controversial. In those days, explanations based on verbal reasoning, or historical observation, or geometric reasoning, were considered theory as long as they were logically expressed. But this sort of reasoning got eclipsed — out-dazzled — by the hyper-mathematical style and eventually was sidelined. I think theory can be and should often be expressed in plain English, as it used to be. I am not saying — emphatically not saying — that anything goes in economics. But I believe no single point of view, no single method, no single coterie of economists, has a monopoly on seeing the economy. Economics quite simply is reasoned explanation and we need to widen our view of what this is.

Q. Is there a link in your piece with nonequilibrium in economics?

A. Very much so. You can't bring in nonequilibrium without having a means to talk about process, because what happens in nonequilibrium is always some process of sense-making and exploring and trying new actions, and these can't easily be captured by changes in noun quantities. That's why nonequilibrium has been hard to treat in equation-based theory.

Q. Doesn't your argument carry over to other sciences? Physics for example?

A. Yes. Equation-based mathematics is an old workhorse of physics and most branches of engineering. And it is appropriate there. Physics deals with forces, fields, mass, time, distances, velocities, and so on; and these are all nouns, so standard mathematics works pretty well here. But modern physics — condensed matter physics for example — deals heavily with processes: how patterns form; how outcomes relax into different metastable states; how systems that show self-organized criticality work. Understanding here is achieved by a combination of qualitative insight and computational experiment and I'd like to see more of that in economics.

Q. Would you say that modern mathematical economics has been useful overall in economics?

A. I'd say yes, but it's a qualified yes. I very much like the work of Arrow, Debreu, and others who clarified general equilibrium theory and made rigorous other branches of economics. And I like mathematics in finance, which is rightly quantitative — the derivation of the Black-Sholes formula for example. That's been useful. But I don't think the hyper-mathematical turn delivered as much as was promised. It brought a massive cleaning of the stables to economics in the form of logical clarity; but it brought no telescope pointed at the stars.

Q. You talk about algorithms, not about computation. Why is that?

A. Algorithms are methods, they are general processes. Computations are narrower; we tend to think of them as "computing out" the numerical consequences of some set of instructions. So Gale and Shapley's college admission algorithm is a general process, a way of thinking about matching students with colleges, and using it in a particular setting is a computation. Roth's organ allocation process is an algorithm too, not a computation. These are solutions to particular economic problems and are abstract processes — algorithms — not particular computations. Turing viewed algorithms as mathematical objects in themselves, and used them abstractly in his proofs. Algorithms are a different form of mathematics and, as my friend Greg Chaitin and Steven Wolfram have shown us, they exist in a different world, one that's just as mathematical — logical — as the equation-based one. I'm not against computation and I'm an early developer of agent-based models, but I want economics to embrace process, and to do this abstractly, not just by computing everything out. I want to get away from the idea that with the new digital possibilities we should simply throw economic problems into a computer.

Q. You said algebraic mathematics is limited to nouns only. But aren't there process algebras and other ways of dealing with actions?

A. Yes. Mathematics as a general discipline is wide, and there are other types of mathematics that can deal with processes. But in the article I'm talking strictly about the type of mathematics used in economic theory papers and textbooks: algebra, linear algebra, and calculus. These have been great workhorses for theorists like me, but they restrict expression. Geometry used earlier in economics is also limited to graphing noun-quantities, and it doesn't work above 3 dimensions. This doesn't mean that geometry or standard mathematics aren't usable in economics. It just means they have limitations, and as theorists we need to be aware of these.

Q. Don't you think that equation-based mathematics is locked in to economics and will not change?

A. It doesn't need to change. I believe equation-based economics will persist and ought to persist as long as we understand its limitations. At the very least it serves as a benchmark. But economics changes as its methods change, and this has happened many times, as geometry, algebra, calculus, and statistics have come in. Each provided new modes of understanding and economics has retained them all, assigning each to its place. Currently we have computation changing economics and that's something being sorted out.

I think economics overall will change because all the sciences are changing. They are wondering how structures are generated. They are getting away from static objects to ideas of process. They are embracing uncertainty, ill-definedness, and unpredictability, and dropping their Newtonian insistence on a predictable, ordered world. Economics is opening slowly to this change in Zeitgeist and beginning to accept nonequilibrium, ill-defined problems, and processes. Computation I believe is catalyzing this change and making it possible, and so is biology, which is a field of processes (speciation, embryonic development, molecular replication, neural interaction, immune response, protein expression) responding to and inhibiting other processes. It's inevitable that economics will open to these changes in the thought of our times.

Q. What do you hope this paper achieves?

A. I would like economists to be aware that the mathematical language we choose to express theory in shapes how we understand the economy. Algebraic mathematics gives us a view of the economy that works well for narrow questions of allocation — how quantities are determined; computational mathematics works better when we need to deal with actions and processes, as when we want to understand questions of formation and nonequilibrium.

I don't believe there is a final, theoretical mode that can reveal all there is to know about the economy. And I'd like to validate an older form of theorizing, where thoughtful discourse and reasoning in words are allowed. Historical reasoning has been pushed under by the extreme math emphasis, and I'd love to see that come back in full. I think Austrian economics, which deals very much with processes has been unfairly treated and I'd like to see that gaining the respect it deserves. And I think computation has a central place in economics, but it needs to proceed thoughtfully as an algorithmic approach, not just in the narrow form of agent-based computational modeling.